- CODE NEVER LIES

- Posts

- Microservices Best Practices in Banking Applications

Microservices Best Practices in Banking Applications

Microservices Best Practices in Banking Applications

"Banking is not just about money; it's about trust, integrity, and the foundation of strong economies."

Microservices architecture has become increasingly popular in the development of banking applications due to its ability to enhance agility, scalability, and maintainability. Implementing best practices is crucial to ensure the success and efficiency of microservices-based systems in the banking sector.

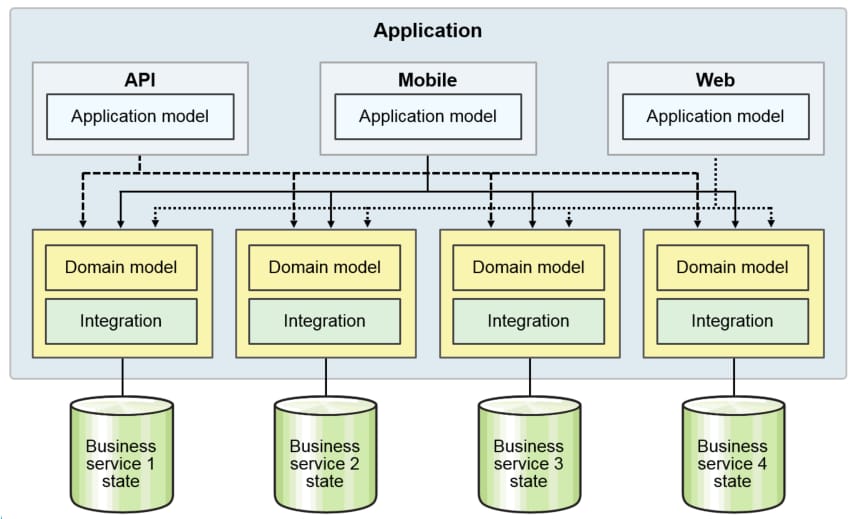

Domain Driven Architecture

1. Domain-Driven Design (DDD):

a) Description:

Domain-Driven Design (DDD) is an approach that aligns software design with the business domain it is built to serve. It emphasizes defining and understanding the domain, creating a common language between business and development teams, and organizing code accordingly.

b) Example:

In a banking application, DDD involves identifying core domains such as account management, transactions, and customer relationships. Each domain is represented by a microservice, fostering modularity and independent development.

c) Advantages:

1. Clear Understanding: DDD provides a shared understanding of the business domain, reducing communication gaps between development and business teams.

2. Modular and Evolvable: Microservices based on DDD principles are modular, allowing easier updates and changes to specific domains without affecting the entire system.

2. Decentralized Data Management:

a) Description:

Decentralized data management involves each microservice managing its own database. Microservices communicate with each other through APIs rather than sharing a common database, reducing dependencies.

b) Example:

In a banking application, customer information, account details, and transaction history are managed by separate microservices. They interact through well-defined APIs, ensuring data consistency without a monolithic database.

c) Advantages:

1. Isolation and Autonomy: Decentralized data management allows microservices to operate independently, reducing the risk of a single point of failure.

2. Scalability: Each microservice can scale its database independently based on its specific needs, optimizing resource utilization.

3. API Gateway for Security:

a) Description:

API Gateway acts as a single entry point for managing and securing all API requests. It enforces authentication, authorization, rate limiting, and other security features, ensuring a consistent and secure communication layer.

b) Example:

In a banking microservices architecture, an API Gateway validates user credentials, authorizes access to account information, and encrypts communication between microservices, safeguarding sensitive data.

c) Advantages:

1. Security Centralization: API Gateway centralizes security measures, simplifying the implementation of consistent security protocols across all microservices.

2. Scalability: By offloading security functions to the API Gateway, microservices can focus on their core functionality, improving overall system scalability.

4. Containerization and Orchestration:

a) Description:

Containerization involves packaging an application and its dependencies into a standardized unit (container), and orchestration tools manage the deployment, scaling, and operation of these containers.

b) Example:

Using Docker containers to encapsulate microservices in a banking application, and Kubernetes for orchestrating these containers, ensures efficient resource utilization, scalability, and seamless deployment.

c) Advantages:

1. Portability: Containers ensure consistent environments across development, testing, and production, reducing issues related to dependencies.

2. Scalability and Resource Efficiency: Orchestration tools like Kubernetes enable automatic scaling of microservices based on demand, optimizing resource usage.

5. Continuous Integration and Continuous Deployment (CI/CD):

a) Description:

CI/CD is a set of practices that automate the integration of code changes, testing, and deployment, ensuring a consistent and reliable process for delivering software updates.

b) Example:

In a banking microservices environment, CI/CD pipelines automate the testing and deployment of each microservice. Any code changes trigger the pipeline, ensuring quick and reliable updates.

c) Advantages:

1. Quick Feedback Loop: CI/CD allows rapid identification and correction of issues, ensuring a quick feedback loop and continuous improvement.

2. Reduced Deployment Risks: Automated testing and deployment reduce the risk of human error, enhancing the overall reliability of the banking application.

6. Fault Tolerance and Resilience:

a) Description:

Fault tolerance involves designing microservices to handle failures gracefully, ensuring the system can recover from faults without significant disruption.

b) Example:

Implementing redundant microservices, load balancing, and graceful degradation in a banking application ensures that even if one microservice fails, the system remains operational, providing a seamless user experience.

c) Advantages:

1. Increased Reliability: Fault-tolerant microservices enhance the overall reliability of the banking application, reducing the impact of potential failures.

2. User Experience: Resilience ensures continuous service availability, maintaining a positive user experience during unexpected events.

7. Monitoring and Logging:

a) Description:

Effective monitoring and logging involve implementing tools and practices to track the performance, health, and behaviour of microservices in real-time.

b) Example:

Utilizing monitoring tools like Prometheus and centralized logging systems such as ELK (Elasticsearch, Logstash, Kibana) in a banking microservices architecture enables proactive identification of issues and efficient troubleshooting.

c) Advantages:

1. Proactive Issue Identification: Monitoring allows quick detection of performance issues, enabling timely intervention before they impact the user experience.

2. Efficient Troubleshooting: Centralized logging simplifies the process of identifying and resolving issues, improving the overall system's maintainability.

8. Automated Testing:

a) Description:

Automated testing involves creating and running tests for microservices automatically, ensuring consistent and reliable results.

b) Example:

In a banking microservices environment, automated unit tests, integration tests, and end-to-end tests are incorporated into the CI/CD pipeline. This ensures that changes to microservices are thoroughly tested before deployment.

c) Advantages:

1. Efficiency: Automated testing reduces the time and effort required for testing, allowing developers to focus on improving functionality.

2. Consistency: Automated tests provide consistent and reproducible results, reducing the risk of human error in the testing process.

9. Scalability Planning:

a) Description:

Scalability planning involves anticipating future growth and designing microservices to handle increased loads by implementing horizontal or vertical scaling strategies.

b) Example:

In a banking application, a microservice responsible for processing transactions is designed to scale horizontally, allowing the system to handle an increased number of transactions by adding more instances of the microservice.

c) Advantages:

1. Cost Efficiency: Scalability planning ensures resources are allocated efficiently, preventing unnecessary over-provisioning and reducing operational costs.

2. User Satisfaction: Properly scaled microservices provide a seamless experience for users, even during periods of increased demand.

10. Regulatory Compliance:

a) Description:

Regulatory compliance involves designing microservices to adhere to industry-specific regulations and standards, ensuring data security and legal requirements are met.

b) Example:

In a banking microservices architecture, ensuring compliance with regulations such as GDPR, PCI DSS, and local financial laws is crucial. Implementing encryption, access controls, and audit trails helps meet regulatory requirements.

c) Advantages:

1. Risk Mitigation: Regulatory compliance reduces the risk of legal consequences and fines, ensuring the banking institution operates within the bounds of the law.

2. Customer Trust: Compliance with industry standards enhances customer trust by demonstrating a commitment to protecting sensitive financial information.

11. Documentation:

a) Description:

Comprehensive documentation involves creating and maintaining detailed documentation for each microservice, including APIs, dependencies, and deployment procedures.

b) Example:

In a banking microservices environment, documentation includes API specifications, data models, deployment instructions, and troubleshooting guides. This facilitates collaboration among development, operations, and support teams.

c) Advantages:

1. Knowledge Transfer: Well-documented microservices simplify knowledge transfer among team members, ensuring continuity in case of personnel changes.

2. Troubleshooting: Documentation aids in troubleshooting and problem resolution, reducing downtime and improving the overall stability of the banking application.

In the dynamic world of banking apps, microservices act as turbochargers. These best practices are your superhero team, working seamlessly to create a resilient and user-friendly experience. Speak your business's language, keep things independent yet connected, and always have that superhero radar on. Your banking app is not just an app; it's a dynamic ecosystem, ready to adapt and thrive. Here's to a future where microservices lead the charge, making your banking app a benchmark for innovation.

If you’re looking for someone to talk to about software development, agile methodologies, or the cloud or software industry in general then feel free to revert me back.

Also if you have any suggestions regarding my blog, drop a comment so I can do better next time.

till then...

Happy Reading..!

Thank you.